Pension system needs deep structural reset – Axis Pension CEO

By Joshua Worlasi AMLANU

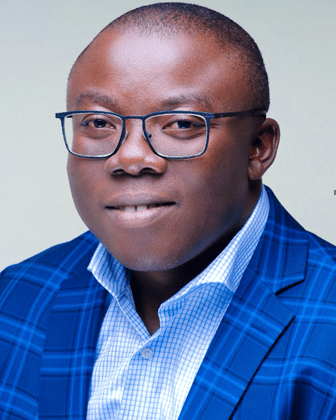

The pension industry requires sweeping structural reforms to safeguard the long-term retirement security of workers, Chief Executive Officer-Axis Pension Trust Afriyie Oware has said.

Delivering opening remarks at the 2025 Pension Investment Strategy Conference in Accra, the CEO called for a bold rethink of how pension assets are allocated – warning that current investment patterns are placing workers’ retirement savings at risk.

The past seven years have tested the pensions system’s resilience. A sequence of economic shocks – from the financial sector clean-up and COVID-19 to Ghana’s historic sovereign default – have exposed the current investment framework’s fragility.

Mr. Oware argued that while recent guidelines aim to encourage diversification, trustees remain overly concentrated in government securities due to a lack of viable investment alternatives.

“By 2023, 83 percent of pension assets were still parked in government bonds,” he said. “This pattern persists despite the heavy losses suffered during the domestic debt exchange. Trustees still hadn’t pivoted not because they didn’t want to, but because the options weren’t there.”

The evolution of Ghana’s pension investment landscape has been marked by missed opportunities.

From the conservative early years under the maiden 2012 guidelines to a post-crisis era characterised by extreme risk aversion, trustees have repeatedly retreated into what they perceive as safe havens – government debt – even as fiscal conditions deteriorated.

The most recent reforms in 2021 removed mandatory government bond allocations and introduced lifecycle funds, but implementation has been underwhelming.

Mr. Oware described the persistent overexposure to sovereign debt as a rational response to an irrational system. “Is this irrational behaviour or a rational response to limited choices?” he asked. “The likely answer: maybe both.”

To break the cycle, he laid out a six-point plan for a system reset – starting with urgent capital market reforms. Ghana’s equity allocation sits at a mere 3 percent, a reflection of limited listings, weak governance practices and low market liquidity.

“Without a vibrant stock exchange, long-term growth capital will remain elusive,” he said.

Corporate debt markets are also lagging. Non-performing loan ratios exceed 24 percent and corporate bonds account for only 1.5 percent of total bond market activity.

The CEO urged a push toward stronger credit infrastructure, including credible issuer ratings and strategic consolidation of Ghanaian businesses through mergers and acquisitions to achieve scale and improve transparency.

The money market, another underutilised avenue, remains fragmented and dominated by opaque over-the-counter bank transactions.

He proposed that the Bank of Ghana and Ghana Stock Exchange collaborate to create a structured issuance platform for negotiable deposits and formalise a commercial paper market under GSE’s new rules.

The post Pension system needs deep structural reset – Axis Pension CEO appeared first on The Business & Financial Times.