Finance Minister charges new NIC board to expand insurance coverage – Nsemkeka

The Minister for Finance has charged the newly inaugurated Board of the National Insurance Commission (NIC) to expand insurance coverage and access to all segments of Ghanaian society, with a particular focus on the informal and agricultural sectors.

Speaking on behalf of the Finance Minister, Dr. Cassiel Ato Forson, the Deputy Minister for Finance, Thomas Nyarko Ampem, expressed concern over Ghana’s low insurance penetration rate, currently below 2%.

“We must think differently, act boldly, and innovate deliberately to build a thriving and inclusive insurance ecosystem,” the Deputy Minister emphasised.

He highlighted the critical importance of extending insurance protection to the informal sector, which constitutes nearly 80% of Ghana’s economy. The Deputy Minister stressed the need for insurance products that are tailored to the everyday realities of farmers, artisans, market traders, and other under-served groups.

“When a farmer in Garu loses a harvest to floods, or a trader in Makola loses stock to fire, the absence of insurance becomes an economic vulnerability,” he noted. “We cannot afford to leave the majority of our population unprotected.”

Mr. Ampem also underscored the growing threat of climate change, particularly as Ghana chairs the Vulnerable Twenty (V20) Group—a coalition of the world’s most climate-vulnerable countries. He emphasised the vital role of insurance in strengthening national resilience, supporting disaster recovery, and safeguarding long-term economic stability.

“Insurance must be a tool for climate resilience, a buffer for shocks, and a safeguard for our gains,” he said. “This is why embedding Environmental, Social, and Governance (ESG) principles into insurance operations is no longer optional.”

The Deputy Minister further urged the NIC and industry stakeholders to improve enforcement of compulsory insurance laws—such as those for motor vehicles and commercial properties, by leveraging technology and systemic reforms rather than relying solely on punitive measures.

In his remarks, the Chairman of the newly inaugurated Board, Mr. Christopher Boadi-Mensah, expressed deep gratitude for the confidence reposed in them and pledged the Board’s commitment to transformative leadership. “We accept this honour with humility and a strong sense of purpose,” he stated. “We are inspired by the call to make insurance more inclusive and accessible, especially to the many Ghanaians in the informal and agricultural sectors who remain unprotected.”

He outlined four core priorities that will guide the Board’s mandate:

- Expanding access to insurance nationwide;

- Deepening market penetration and awareness through education and outreach;

- Fostering innovation and digital transformation to modernise service delivery;

- Ensuring the insurance sector contributes meaningfully to employment, economic growth, and national well-being.

With the President’s “24-Hour Economy” vision gaining momentum, both the Ministry and the NIC Board acknowledged the critical role of a responsive, technology-enabled insurance sector in supporting continuous economic activity.

The inauguration marks a new chapter for Ghana’s insurance landscape—one rooted in collaboration, bold leadership, and a shared commitment to delivering financial security for all.

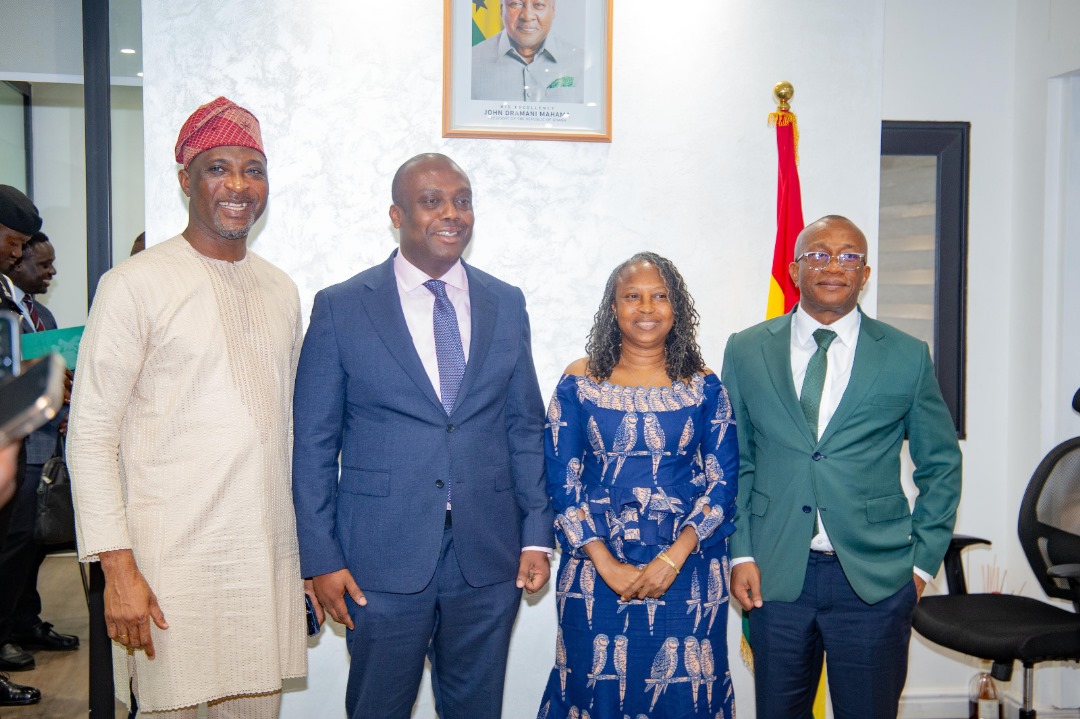

Members of the Board of NIC

Christoher Boadi Mensah – Chairman –

Dr. Abiba Zakariah – Commissioner of NIC

Mr. David Klotey Collison – Member

Mr. Emmanuel Amofa – Member

Mr. Matthew Kweku Atta Aidoo – Member

Ms. Jean-Marie Formadi, MP – Member (President’s Nominee, Member)

Mr. Simon Akibange Aworigo – Member (President’s Nominee, Member)